Getting Down To Basics with

Managing taxes can be frustrating and taxing. As a liable person or company owner, you intend to make sure that your taxes are submitted accurately and in a timely manner. This is where a tax preparation service enters into play. Whether you have a basic W-2 earnings or complicated company purchases, a tax obligation preparation service can aid streamline the tax declaring procedure and offer you with peace of mind.

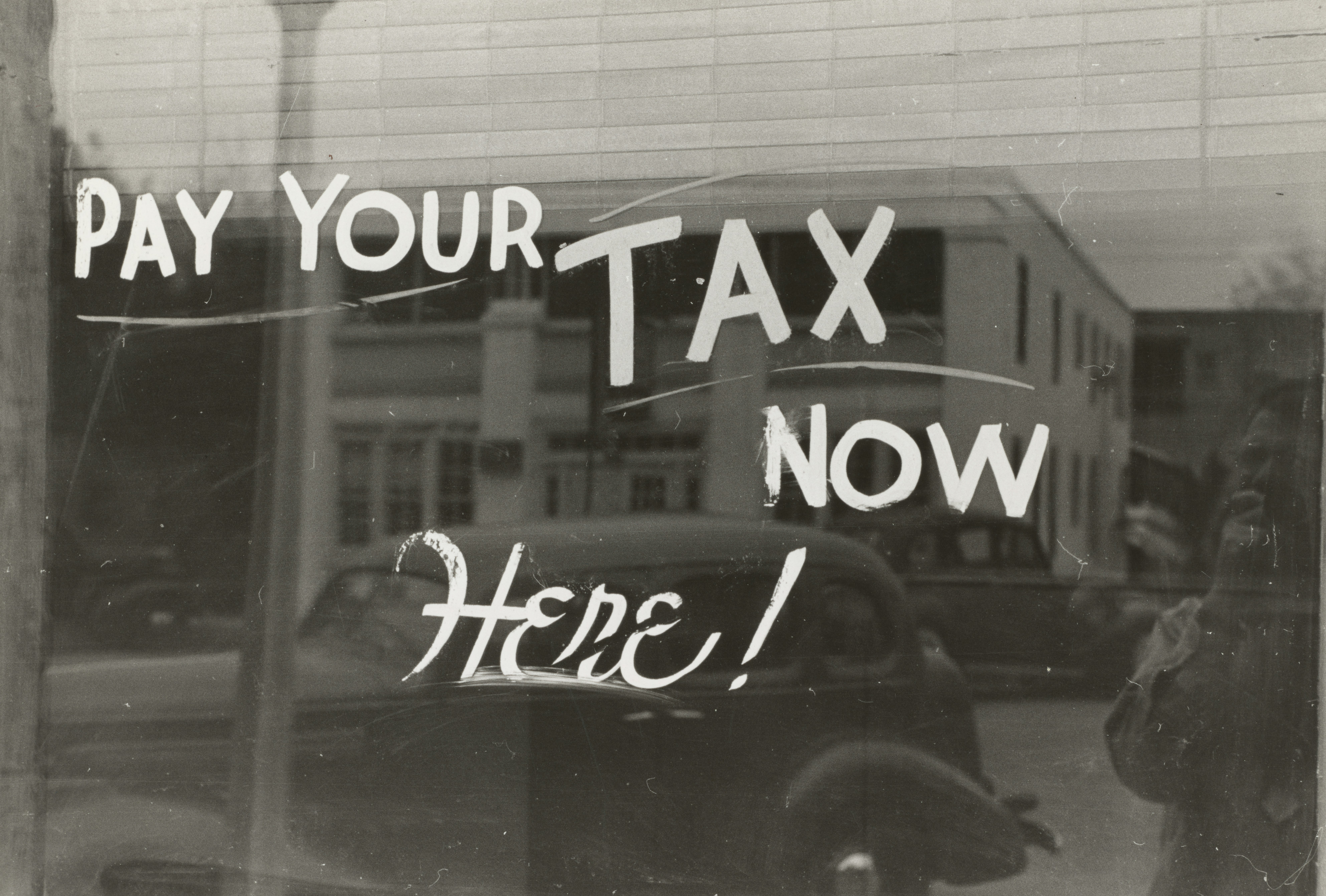

1 Picture Gallery: Getting Down To Basics with

Among the essential advantages of utilizing a tax prep work solution is the proficiency and expertise they give the table. Tax legislations and laws are regularly changing, making it difficult for individuals to stay updated. Tax obligation experts in a tax obligation prep work solution are educated and experienced in tax obligation regulation, enabling them to browse via the intricacies and guarantee compliance with the latest policies.

Moreover, tax obligation prep work solutions utilize innovative software application and innovation to simplify the tax obligation prep work procedure. They have accessibility to software program that can precisely determine your tax obligations, determine deductions and credit scores, and lessen the possibilities of mistakes. This not only saves you time yet likewise decreases the risk of setting off an audit by the tax obligation authorities.

Another considerable benefit of employing a tax obligation prep work solution is their capacity to help you make best use of deductions and credit scores. They have a thorough understanding of the tax code and can identify potential reductions and credit reports that you might have overlooked. This can cause substantial financial savings on your tax obligation costs and boost your chances of getting a bigger tax obligation reimbursement.

In addition to their expertise and knowledge, tax preparation services can also give assistance and aid in the event of an audit or an IRS notification. They can direct you with the procedure, represent you prior to the internal revenue service, and aid solve any kind of concerns that might develop. Having a specialist at hand can alleviate anxiety and make certain that your legal rights are protected throughout the audit procedure.

To conclude, working with a tax obligation preparation solution can simplify the tax declaring process and offer numerous advantages. From their proficiency in tax regulation to their innovative software program and ability to optimize deductions, tax obligation professionals can make sure precision, save you time, and potentially decrease your tax obligation. So, why stress and anxiety over taxes when you can rely upon qualified specialists to manage them for you?

The Essentials of – Breaking Down the Basics

This post topic: Business Products & Services